On June 6, the Ministry of Industry and Information Technology issued 5G commercial licenses to China Telecom, China Mobile, China Unicom and China Radio and Television, officially announcing the arrival of the 5G era.

As the basic building block of the 5G network physical layer, the core components in the base station and transmission equipment, the optical module industry has also ushered in a new round of development opportunities. China Merchants Securities predicts that 5G commercial will greatly increase the demand for optical modules. In the future, 5G national coverage will require the construction of nearly 10 million base stations. The demand for potential hundreds of millions of high-speed optical modules will exceed 30 billion yuan in the previous market. Ten billion dollars.

Ten thousand orders of new usage, transmission / access / digital communication and other wide-ranging application scenarios, the market seems to be thriving; but the surface of the prosperity is difficult to hide behind the difficult steps, the price of optical modules continues to fall, the industry is excessively competitive, high-end (products The slow localization process, the core chip is subject to people, and the uneven development of the industrial chain have become problems that plague the domestic industrial chain.

Attractive "foreground"

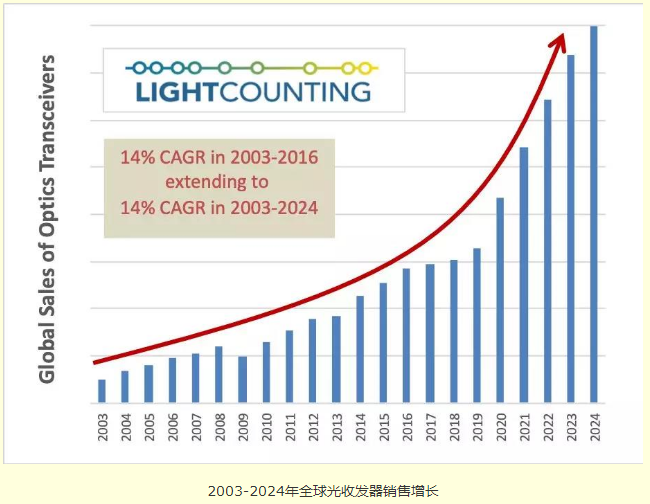

According to the latest optical communication market forecast released by LightCounting, 5G is scheduled to be deployed or become one of the three major events that will enable the global optical transceiver market to achieve a 14% compound annual growth rate (CAGR) between 2003 and 2024. Has been issued, took the first step in the market forecast.

Wei Leping, executive deputy director of the Communication Technology Committee of the Ministry of Industry and Information Technology, believes that the 5G era optical module will usher in huge opportunities. According to the uplink edge rate of 3Mbps and different networking modes, the number of 5G outdoor macro stations required is at least 1.2-2 times of 4G; Coverage mainly relies on tens of millions of small base stations, and 5G is expected to bring tens of millions of 25/50/100Gbps optical modules. China Merchants Securities predicts that the scale of the 5G era macro base station will reach 5 million, and the number of small base stations will reach nearly 10 million. The total investment of the three major domestic operators is close to 165 billion US dollars, which is nearly 50% larger than the 10G period of 110 billion US dollars.

The forecast of Guolian Securities is also optimistic, and it believes that the 5G optical module will have a market of nearly 70 billion. For 5G bearers, 25/50/100Gb/s new high-speed optical modules are gradually introduced in the pre-transmission, intermediate transmission and back-transmission access layers. The N×100/200/400Gb/s high-speed optical modules are widely used in the backhaul convergence and core layers. Introduced.

In addition, the data center's transition to two-tier architecture will also increase the demand for optical modules. According to Ovum's statistics and forecasts, 100Gb/s optical modules will start to grow rapidly in 2017. It is expected that by 2022, 100Gb/s optical module sales revenue will be achieved by 2022. Will exceed $7 billion.

Bitter prospect

Under the stimulation of various factors, the demand for optical modules is rising, and the prospects on the surface are good. However, the current situation of the optical communication market is that the price of modules is falling, and it is not easy for manufacturers to make a dilemma.

The high demand for explosive growth has led to fierce competition in the market, which in turn has led to a decline in prices in the optical communications industry. In terms of PON optical modules, prices are also falling. Dai Qiwei, product manager of Guangxun terminal access product line, said that the global PON series product investment trend, 10GPON OLT/ONU may usher in a rapid outbreak time window, the compound annual growth rate is expected to reach 50% or more, which will lead to increasingly fierce market competition. The price of PON optical module products will show an avalanche.

On the one hand, the price of optical modules is declining year by year, and this decline will accelerate in the 5G era; on the other hand, the market drawbacks of excessive competition in enterprises are gradually revealed, and ecological health is broken. As a domestic optical module manufacturer of TOP3, Hisense Broadband CTO Li Dawei pointed out that “the phenomenon of not participating in competition is completely out of competition, and participation in competition is equivalent to chronic suicide” has become the industry's crux.

The uneven development of the industrial chain is also the pain point of the industry. From the perspective of revenue, in the optical communication industry, the gross profit margin of equipment manufacturers and chip manufacturers is relatively high, while the gross profit margin of foundry and component packaging is less than 10%. High investment and high profit can help the company's metabolism. On the contrary, it is difficult to achieve continuous innovation with low gross profit margin, which is a challenge for related companies.

In addition, the localization process of high-end chips has been slow, and it has become a serious injury in the development of the domestic optical communication industry. In the past ten years, in addition to the core optoelectronic chips, although domestic enterprises have an advantage in chip packaging and module production capacity, they still rely heavily on foreign suppliers for high-end optical chips and electric chips, and the demand for localization is urgent.

It is undeniable that from the perspective of the entire 5G optical module market, operators and major equipment manufacturers are actively investing, and the cake is indeed big enough; however, when entering the ranks of food, this cake is slightly bitter.